Most users believe that visiting a variety of websites on their computers is completely secure. However, this is a misconception since there are many intelligence services that watch users nowadays, making it important to protect your privacy by accessing the internet safely. It’s time to use your Android to search the internet safely, as you do not realize that your browser can be used to spy on you.

Security is still a top priority in the cyber world, regardless of where you are. Protected browsing, on the other hand, is a method of surfing the web securely and anonymously. The majority of users believe that visiting several websites on their browser is completely secure.

List of the Best Secure Android Browsers for Safe Web Browsing

I’ll show you some of the best stable browsers for Android that are still in incognito mode and clear your data when you close them. These will ensure that you have a secure browsing experience on your Android device.

Take a look at the following browsers.

1. DuckDuckGo Privacy Browser

It’s one of the most stable web browsers available on the Google Play Store for Android. DuckDuckGo Privacy Browser is perfect and it has everything you need to protect your privacy. The DuckDuckGo Privacy Browser for Android will block advertisements and trackers while not requiring web pages to use an encrypted link. DuckDuckGo Privacy Browser, on the other hand, allows users to search privately.

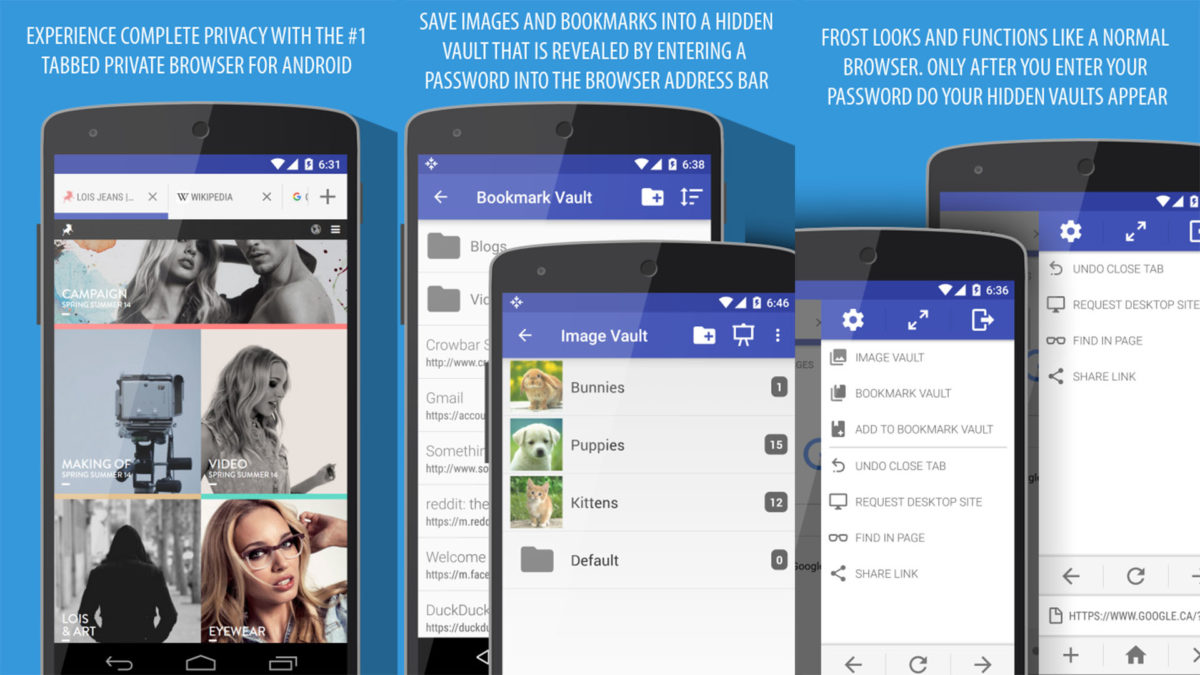

2. Frost Incognito Browser

It is also another excellent private browsing application for Android. Frost Incognito Browser is unique in that it has a secret, password-protected image and bookmark vault where you can store confidential information. Aside from these, the browser also has a number of other privacy options.

3. Firefox Focus

If you’re searching for a web browser that lets you search like no one’s around, Firefox Focus is the one to try.

A broad variety of online trackers are immediately blocked by the Android web browser. All of your browsing history, cookies, and tackers are immediately deleted when you close the window. Firefox Focus is a lightweight browser that is also very simple to use.

4. Brave Browser

Brave is an Android privacy browser that offers a stable and easy web browsing experience. Popups, advertisements, ransomware, and other malicious scripts are immediately blocked by the Android web browser.

Aside from that, it has a private browsing feature that deletes your browsing history when you leave the browser.

5. Dolphin

If you’re looking for a smooth, private, and stable web browser for your Android device, Dolphin Browser is a must-try. Flash player, pop-up blocker, customized scan, download manager, private browsing mode, and other tools are available in the web browser. It only has a private browsing mode and does not store the browsing history or cookies for security reasons.

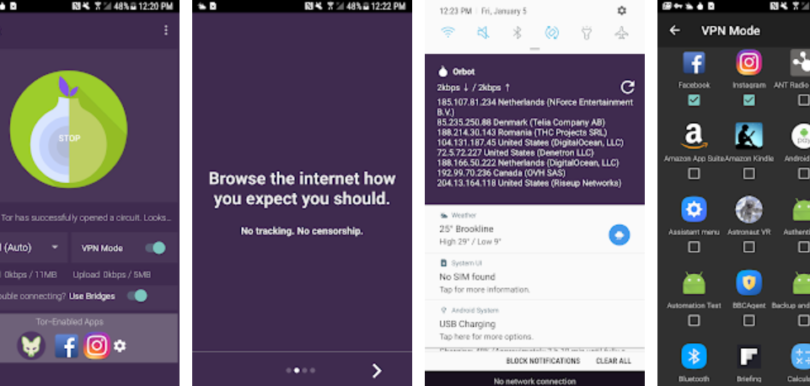

6. Orbot: Proxy with Tor

It’s a free proxy tool that allows other users to anonymously access the internet. Orbot encrypts the Internet traffic with Tor and then masks it by routing it through a network of machines all over the world.

7. InBrowser – Incognito Browsing

InBrowser is an incognito/private browser for Android that also supports TOR and video. Anything you’ve completed in InBrowser will be deleted any time you exit the program, including your past, cookies, and sessions. InBrowser is a feature-rich browser that runs in private mode all of the time.

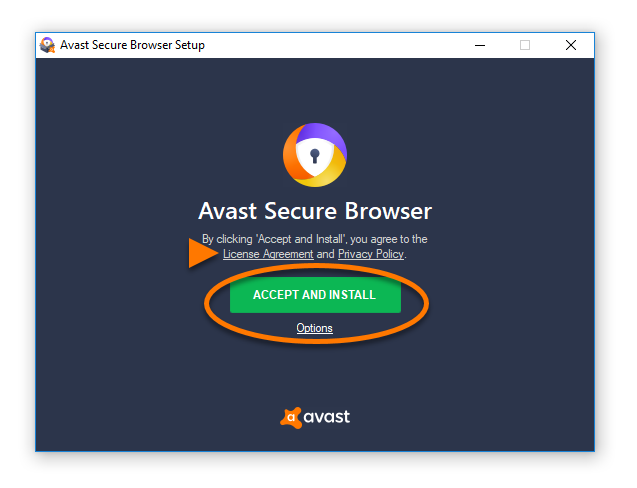

8. Avast Secure Browser

Avast Secure Platform for Android is a modern, feature-rich private web browser software. Let me tell you something. It includes an AdBlocker and a VPN to protect your privacy. avast, one of the leading security firms, created the web browser. The web browser is fast, and it includes an Incognito mode for protecting your personal information.

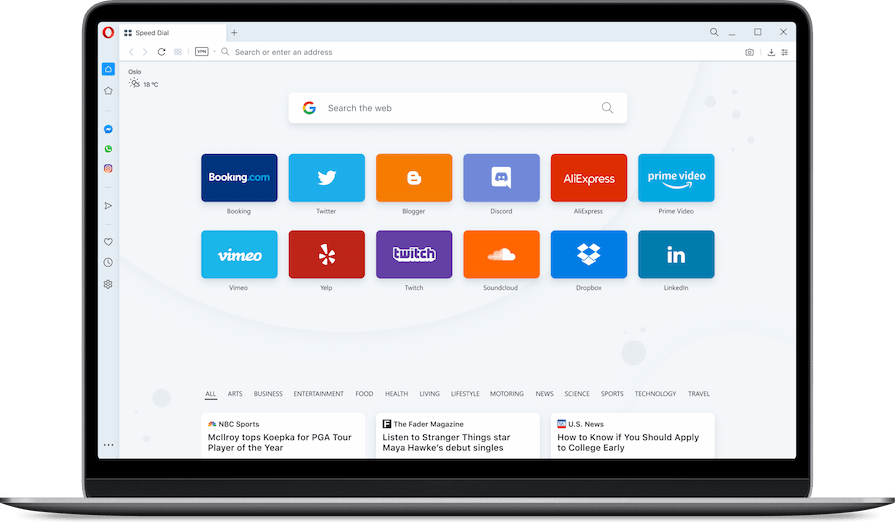

9. Opera browser

The Opera browser is one of the most common Android web browsers available on the Google Play Store.

What’s more, guess what? The browser is fast, safe, and private. It has a built-in ad blocker that removes advertisements from web pages automatically. It also has a VPN function for authentication and privacy.

You can conveniently mask your IP address and unblock websites using a VPN. Opera’s new update also has a night mode and customization options.

10. Ghostery Browser

Any security warning customer is aware of this as one of the best browsers. Private browsing is allowed by default in this common browser. The most important feature is that when you close the window, all data is erased, including browser history, downloaded files, forms, cookies, and passwords. Additionally, this software allows you to navigate websites quickly.

So that’s what there is to it on How To Browse Securely On Android. I hope you found this article useful!

Please pass it on to your mates as well. Please let us know if you know about any other similar web browsers in the comments section below.